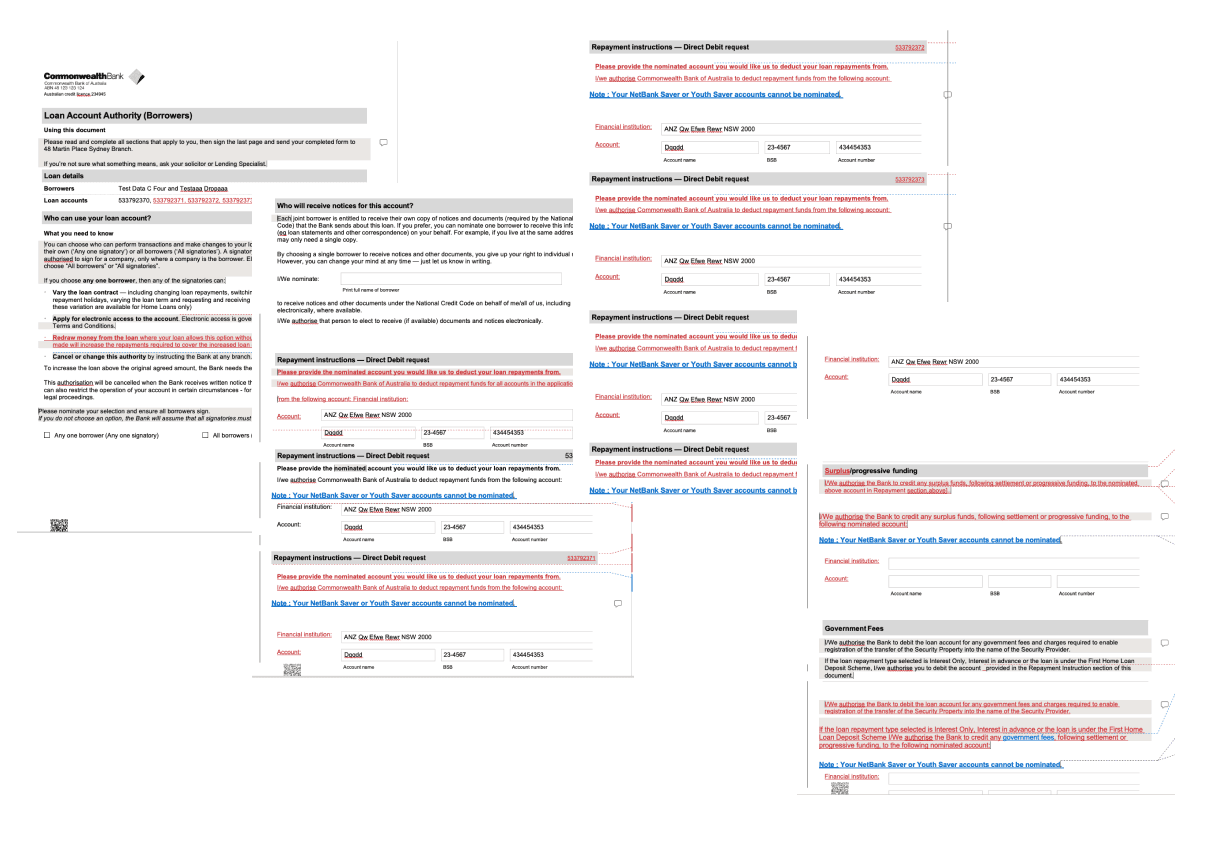

The Loan Account Authority is a document composed of multiple questions, or ‘jobs to be done’ that needs to be completed in the settlement period when buying or refinancing a property. It is one of many documents in the loan document pack issued to customers for signing before settlement.

(PROBLEM)

For the last 15 years we have utilised a paper form that has created 25% rework at the critical stage of preparing for settlement. This brings our customers a large amount of anxiety for a simple step in the process.

(SUMMARY OF OPPORTUNITIES)

There is an opportunity for us to tailor our services and optimise the document upload process based on the customer’s preferred channel. It may be beneficial to assess the differences between these processes and consider providing a more consistent experience for CBA customers regardless of their channel of acquisition.

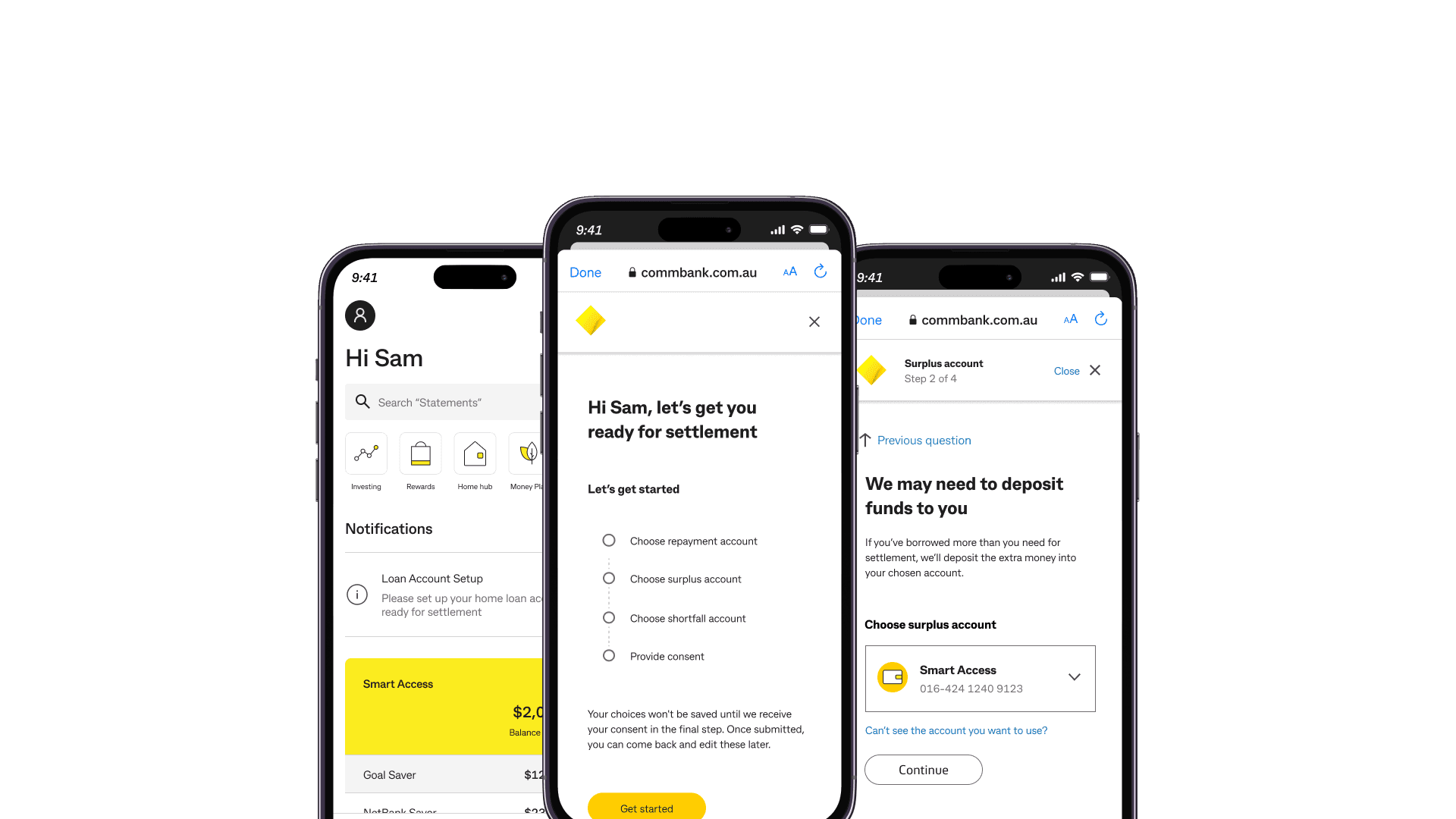

Not only should we provide a seamless experience on desktop during the HL application process but also recognise that mobile phones still play a crucial role in the overall customer journey. Customers may still desire the flexibility and convenience of a mobile phone; therefore it is important we continue to focus on a multi-platform seamless approach.

There is a need for us to consider diverse needs and preferences when implementing digital solutions. While digital signatures are widely preferred and offer convenience, it is crucial to ensure that the process is accessible and user friendly for all customers.

“ A bunch of documents” is how customers describe the loan documents. Providing an overview of what the documents contain, what the steps are and what is required might assist in managing expectations

(OBJECTIVES)

We want customers to complete all of these tasks before the settlement date

We want customers to be able to quickly and easily edit any part of the LAA

We want customers to understand and acknowledge the information within the documents

We want this to become a step that never gets missed within the home loan journey (HomeHub)

(USABLITY TESTING)

I took a proof of concept design and shared with a customer focus group to gather feedback. I then had customers test our prototype to ensure we appropriately understood and managed their needs. Then the real work started to make the dream come true and the Digital Offer Fulfilment Squad coordinated across Home Buying, Operations, Digital and Chief Data Analytics Domains to make this happen. Working across 12 different technical stacks, delivering at LIXI standards and cloud components modernising our technology and building our experience for tomorrows bank !

(RESULTS)

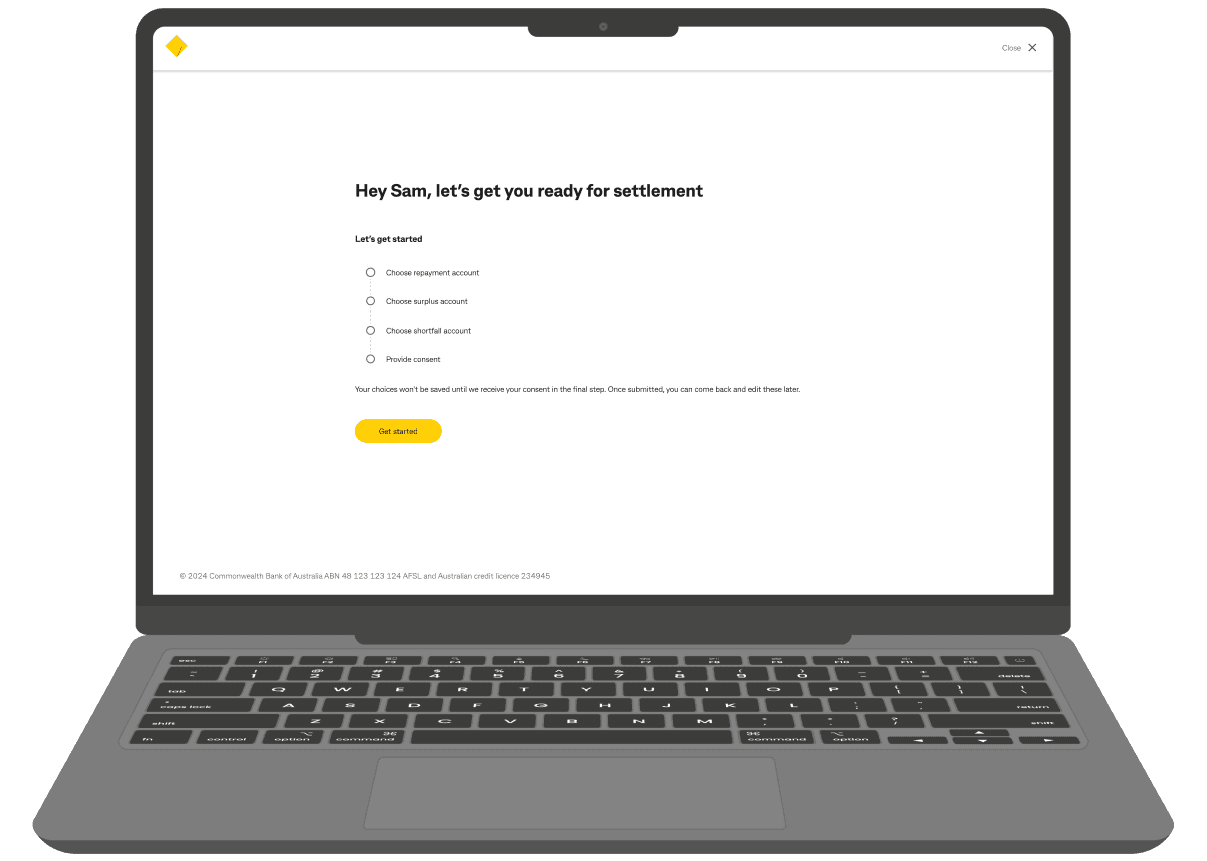

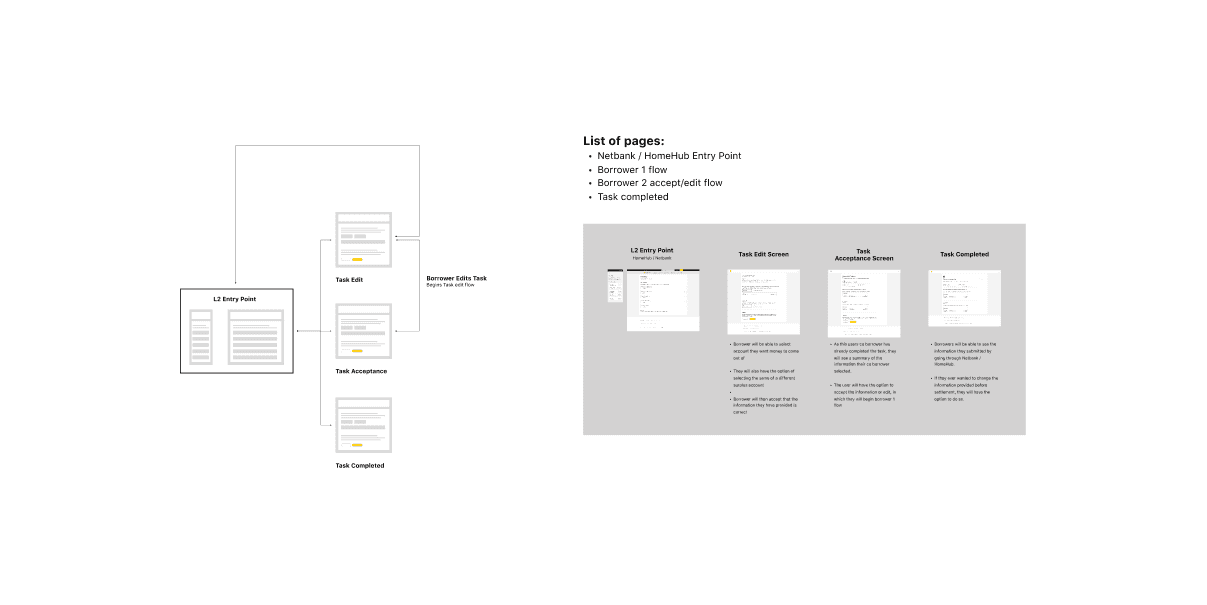

I transformed the LAA form in to a Netbank experience with 4 simple steps ensured we surface the customer eligible accounts in the process, removing customer effort. The additional benefit besides the 25% rework down to 0 rework is we have reduced the number of documents that go out as part of the Loan Offer Pack, good for customers and the environment!

Customers also have the ability to change their mind and self-serve via Netbank amending the Loan Account Set Up instructions at any time prior to settlement. This updated and is available to operations in real-time improving the customer settlement certainty !